When insured person / family gives birth

When a baby is born

|

|

- Procedures for adding a baby as a dependent

※Not required if you want to support your baby in your spouse's health insurance (other than Fujisoft Health Insurance). - Submission of lump-sum payment for childbirth and childcare

※You can apply to Fujisoft Health Insurance if a dependent (family member) or female insured person (employee) who is a member of Fujisoft Health Insurance gives birth.

|

- Request for exemption from insurance premiums during prenatal and postnatal leave

※A female insured person (employee) should notify the employer within 56 days after giving birth. - Submission for maternity allowance request

※A female insured person (employee) can make a claim when absent from company due to childbirth and no salary is paid.

|

- Request for exemption from insurance premiums during childcare leave

The insured person (employee) must notify to the employer.

Note: Only when raising children under 3 years old

|

Put your baby as dependent

| Until when | Promptly |

|---|---|

| Documents to be submitted | Dependent (transfer) notification |

Benefits you can receive when you give birth

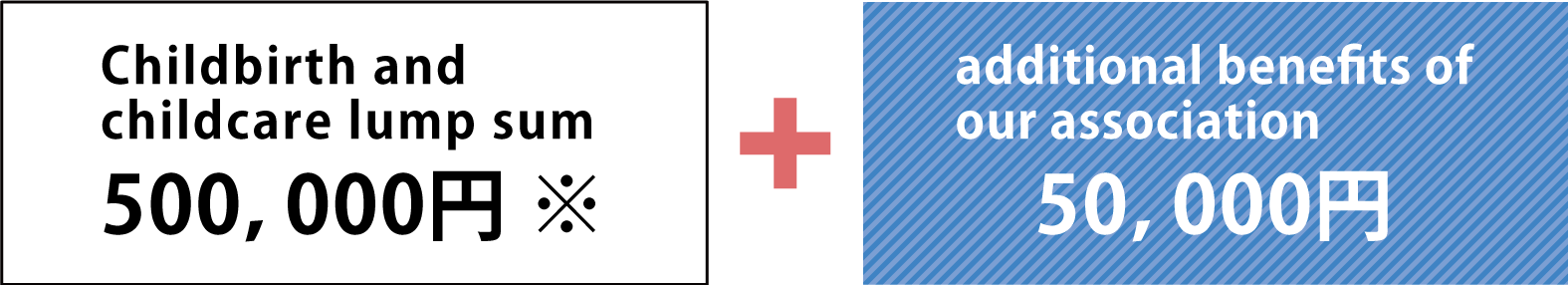

The insurance benefits for childbirth are "childbirth after 4 months (85 days) or more of pregnancy (including caesarean section), premature birth, stillbirth, and abortion (only under the Maternal Protection Law)".

※The right to claim benefits is two years. (Rights will be extinguished after the deadline.)

- In the case of childbirth (including stillbirth) after the 22nd week of pregnancy under medical control of a medical institution that joins the obstetrics medical compensation system.

In the case of childbirth at an institution not participating in the system, 488,000 yen + 50,000 yen (additional benefit of our association) - For multiple children, the number of child

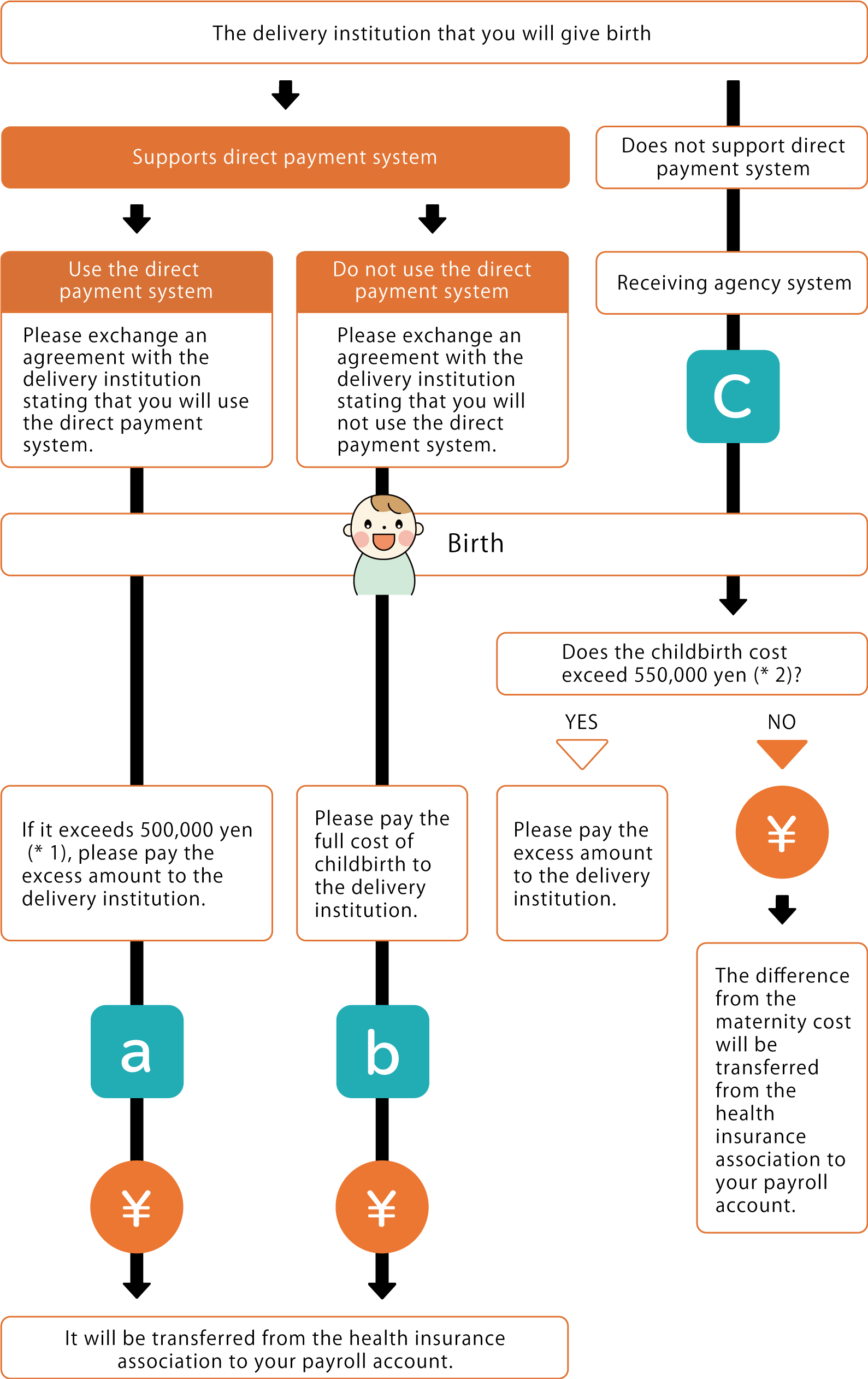

Direct payment system

The health insurance association can pay the lump-sum birth allowance directly to the delivery institution, etc., simply by exchanging an agreement with the delivery institution that gives birth.

As a result, please pay only the amount exceeding the lump-sum birth allowance to the delivery institution.

If the cost of childbirth is less than the lump-sum birth allowance, the difference will be paid by the Health Insurance Society.

Receiving agency system

Even if you give birth at a small delivery institution that does not have a direct payment system, you can apply in advance to the Health Insurance Society that the agent who will receive the lump-sum birth allowance will be the delivery institution where you plan to give birth. The cost burden is reduced.

It can be used at some small delivery institutions that have notified the Ministry of Health, Labor and Welfare.

Note) If you are giving birth overseas, please contact the Health Insurance Society.

Billing Flowchart

- (※1) Childbirth at a delivery institution that is not a member of the obstetrics medical compensation system costs 488,000 yen.

- (※2) Childbirth at a delivery institution that is not a member of the obstetrics medical compensation system costs 538,000 yen.

| Flowchart results |

a Direct payment system |

|

|---|---|---|

| Submission time | After delivery | |

| Documents to be submitted | (For direct payment system) Insured person / family birth / childcare lump sum / additional payment (internal payment) invoice |

|

| Attachment | ① Copy of receipt for childbirth expenses (If you are enrolled in the obstetrics medical compensation system, the receipt is stamped)

|

|

| Submission destination | Submit to the Health Insurance Association via the health insurance office worker at your place company | |

| Flowchart results |

b Do not use the direct payment system |

|

|---|---|---|

| Submission time | After delivery | |

| Documents to be submitted | Insured / family childbirth / childcare lump-sum payment / additional charge invoice | |

| Attachment | ① Copy of receipt for childbirth expenses (If you are enrolled in the obstetrics medical compensation system, the receipt is stamped) ② A copy of the agreement document issued by the medical institution Documents stating that you will not use the direct payment system |

|

| Submission destination | Submit to the Health Insurance Association via the health insurance office worker at your place company | |

| Flowchart results |

c Receiving agency system |

|

|---|---|---|

| Submission time | Before childbirth | |

| Documents to be submitted | (Receipt agency system) Insured person / family birth / childcare lump sum / surcharge bill |

|

| Attachment | ① A copy of the Maternal and Child Health Handbook (page with the name of the child and the expected date, or a document certifying the expected date) | |

| Submission destination | Submit to the Health Insurance Association via the health insurance office worker at your place company | |

- Maternity allowance

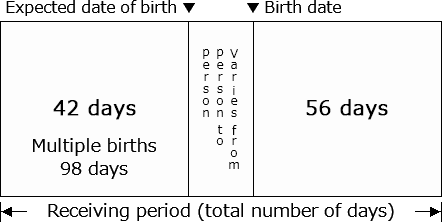

When a female insured person has given birth for 4 months or more and is absent from work and cannot receive all or part of her salary

| Maternity allowance | |

|---|---|

| Documents to be submitted | Maternity allowance invoice Obtain a doctor's certificate and submit it to the health insurance company via the health insurance office worker at your company. |

| Amount received | Maternity Allowance (statutory benefit) Two-thirds of the standard daily salary per day when absent from the company within the receiving period |

|

If you take a maternity leave due to childbirth, you will receive two-thirds of the standard daily salary for each day you take a leave from the company within the payment period.

|

|

The standard daily salary is the standard monthly salary ÷ 30 days (rounded to the nearest 10 yen)

Get exempt from insurance premiums during prenatal and postnatal leave

From the perspective of nurturing the next generation, this system is designed to reduce the financial burden before and after childbirth and create an environment that makes it easier for workers to have children, and is exempt from insurance premiums during the period of taking maternity leave.

※For details, please check with the health insurance office worker at your place of employment.

Get exempt from insurance premiums during childcare leave

This system is designed to make it easier for women to work and for their children to grow up healthy, and is exempt from insurance premiums during the period of taking childcare leave.

Note: This system applies only when raising children under the age of three.

※For details, please check with the health insurance office worker at your place of employment.