When the number of dependents increases

certification of dependent

a What does dependent mean?

Health insurance provides insurance benefits when the insured person (employee) becomes ill, injured, death or childbirth. For insured dependents (family) insurance benefits will be provided for illness, injuries, death or childbirth.

However, not all family members are certified as dependents of health insurance. It is necessary to meet certain conditions stipulated by law.

Health insurance standards for dependents (Family members) are different from company allowances and tax law for dependents. Dependent and Dependent's ( family members) have different standards of tax law. Also the company allowance rule is different.

b certification of dependent

To be certified as a dependent, you must meet the following requirements:

The Health Insurance Society will determine whether or not you are a dependent after rigorous examination according to the following requirements.

Certification requirements

- Living mainly on the income of the insured person ( employee ).

- Being within the range of dependents stipulated by the Health Insurance Law.

- Family annual income is less than 1.3 million yen. Elderly aged 60 and over, or disabled (under 59) compensation must be less than 1.8 million yen per year.

- The annual family income is less than half of the annual insured person income.

- Insured person (employee) has ability to continue the financial support.

- Dependent has reached 75th birthday and living in Japan.

-

In the case of a dependent from another household, the amount of remittance must exceed the family's income.

- Batch remittance and money delivered by hand is not acceptable.

- Proof of remittance such as transfer from a financial institution is required.

< Case where you live separate but exempt from remittance proof. >

- Living alone for company reasons

- Separation due to children going on to school

- Maternity leave / separation due to long-term care

- Long-term hospitalization

- Separated by entering the facility

- Nursing care facility for the elderly (special nursing home for the elderly)

- Long-Term Health Care Facility

- Long-term Nursing Care Facility

- Rehabilitation facility for the physically (intellectual) disabled

-

Have an address (resident's card) in Japan.

< Exemption case of money transfer even you are living different place >

- Studying abroad students

- Family members accompanying overseas assignment

- A child born during an overseas assignment, a married spouse

- Temporary travel for sightseeing, recreation, volunteer activities, or other purposes other than work

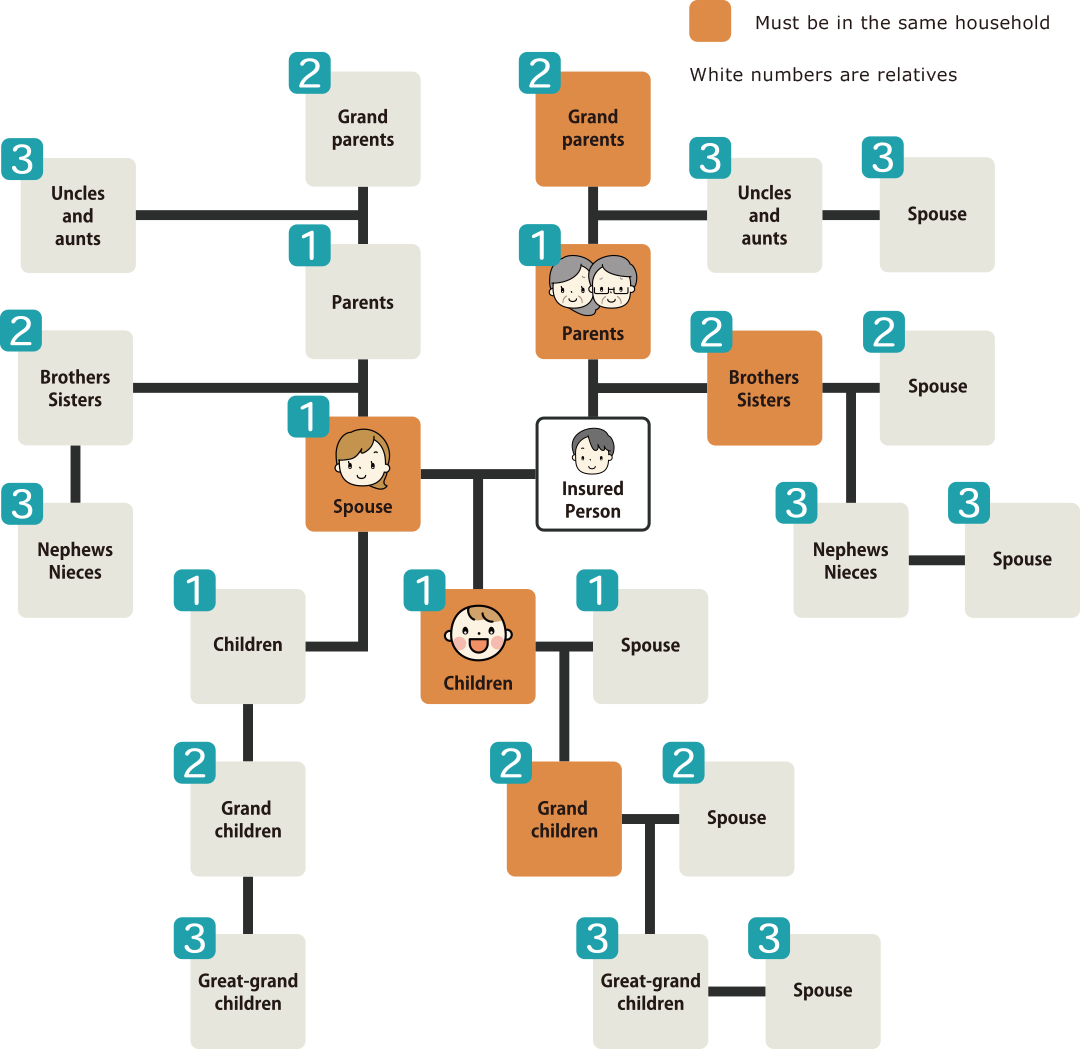

c Scope of dependents (relatives) (as required by law)

- Relatives within the third degree

- However, there are conditions for the same household and different households

-

People who can be in the same household or in different households

- Spouse (including common-law relationship)

- Children (including adopted children), grandchildren, brothers and sisters

- Direct lineage of insured person such as parents (including adoptive parents)

-

People who are required to be in the same household

- Relatives within the third degree other than

- Parents and children of the insured's spouse (including common-law relationships)

- Parents and children after the death of their spouse (including common-law)

- Family members aged 18 to 60 who can work

Usually, they are of a working age and can live independently without the fin

Therefore, in order to become a dependent (family), the insured person (employee) must bear most of the living expenses by proving that he / she is unable to work by submitting documents. It is necessary to declare. - What is the same household?

The insured (employee) and his / her family live in the same house and share the household budget.

Even if you live together, if you live independently of each other and have different household budgets such as meals and living expenses, you will not be recognized as the same household.

d Income of dependents (family)

■ Range of income

- Labor income (including tax-exempt income such as commuting expenses and bonuses)

Part-time job, part-time job, inside job, etc. - Various pension income

Public old-age pension, survivor's pension, disability pension, corporate pension, etc. - Business income

Income from self-employed, agriculture, forestry, fisheries, etc.

Income from insurance agents, piano teachers, etc. - Employment insurance unemployment benefits, etc.

- Compensation for leave from social insurance

Injury and illness allowance, maternity allowance - Support remittance from relatives other than the insured person

- Real estate income, interest income, dividend income, etc. that are recognized as other income

■ How to calculate annual income

- Annual income does not mean past income, but the estimated annual income at the time of being a dependent (family member) and after the date of certification.

- Salary income

Total amount paid for the last 3 months (including commuting expenses) x 4 + annual bonus amount - Self-employed income・・・・・・Total income-necessary expenses

- Real estate income・・・・・・Total income-necessary expenses

- Pension income・・・・・・・Payment amount before long-term care premium insurance and tax deduction

- Interest / dividend income・・・・Total income before tax deduction

- Health insurance injury and illness allowance, maternity allowance・・・ Daily benefit x 360 days

- Employment insurance unemployment benefits・・・・・・・・・Daily benefits x 360 days

| 1 year | 1 month | 1 day | |

|---|---|---|---|

| Under 60 years old | Less than 1.3 million yen | Less than 108,334 yen | Less than 3,612 yen |

| 60 years old and over & disabled |

Less than 1.8 million yen | Less than 150,000 yen | Less than 5,000 yen |

e Dependent Certification Date

- The date on which the "Notification of Dependents (Transfer)" and the required documents are submitted and accepted by the Health Insurance Society after recognizing the fact of support will be the date of certification.

- For birth, the date of birth shall be the date of certification.

- We will submit a document certifying the reason for the transfer within 3.1 months, and only if it is accepted by the Health Insurance Society, we will certify it retroactively to the date when that fact occurred.

There is a period during which you can go back, so please submit the documents immediately after the event occurs.

f Dependent deletion date

- If a dependent gains employment, the date of qualification acquisition on a copy of the document showing their insurance eligibility at their new employer will be the date of deletion.

- If a dependent dies, the date of death will be confirmed and the date of deletion will be the day after the date of death.

- If the dependents exceed the annual income standard, the date of confirmation by the union will be the date of deletion.

- If the dependent's livelihood is changed, the date of deletion will be the date when the union confirms the facts.

If the person falls under the category of a late-stage elderly person (75th birthday living in Japan, the day when the early-stage elderly person (65-74 years old) is certified as having a disability), the date of deletion will be the applicable date.

If you do not make a notification even though you are no longer qualified as a dependent, you will be disqualified retroactively.

If you receive medical treatment under this health insurance scheme after the date of loss of eligibility, you will be required to repay medical expenses, etc.

g There is no health insurance fee for dependents.

Insurance fees are determined by the monthly remuneration of the insured (employee).

It does not change even if the number of dependents (family members) increases or decreases.

h We conduct a reconfirmation survey of dependent qualifications every year.

Proof of income, proof of pledge, proof of continuous remittance, etc. will be required for the reconfirmation survey.

If you cannot submit it, you will not be able to continue your qualification, so please be ready to submit the required documents at any time.

i If you applied untruth documents

If you apply for a family member who is not dependent on you, your dependent status will be revoked retroactively and you will have to reimburse all medical benefits incurred during that period.

j About submission of my number of dependents

c Extent of dependents (relatives ) (as required by law)

- However, if you want to add dependents after retirement, you do not need to submit it because it will be collected from the Basic Resident Network Register .

k Other

In the examination of dependent certification, if the prescribed documents are not enough, may be ask additional documents

Application documents

| Deadline | Within 5 days from the date of certification |

|---|---|

| Application form | Notification of dependents (transfer) of health insurance |

| Dependent's status table | |

| Attached document | List of attached documents required for application of dependents |

| Receiver | Submit to health insurance via the health insurance office staff at work place |